Forget China or Russia. The US Government is days away from launching an Apocalyptic attack on itself.

(Originally published May 26 in “What in the World“) So here we are, four months since the U.S. Government borrowed its last dollar and less than a week away from what the U.S. Treasury Dept. warns is “X-day,” when it runs out of cash to pay its bills and debts, becoming insolvent, bankrupt.

Reports say U.S. President Biden and House Speaker Kevin McCarthy were inching closer to a deal Thursday night on raising the government’s self-imposed debt ceiling before McCarthy sent House members home for the long Memorial Day weekend. While Congress was told to be ready to slither back if a deal was reached in the meantime, they technically have only two business days left to pass any agreement. And even if they reach a deal, there’s a risk that hardliners in both parties refuse to pass it.

The consequences are going to be tremendous whether or not a deal is reached. A default is clearly the worst of the two, though some might argue the damage has already been done. That the Congress has again willingly risked causing default as part of budget negotiations has already threatened the financial world’s faith in U.S. creditworthiness, which underpins the global prestige of the U.S. dollar as the world’s reserve currency. Default by the world’s largest borrower, moreover, would likely send financial markets into further turmoil and hasten what many have already predicted is an oncoming economic recession.

Any deal is also likely to be a Faustian bargain. Even a cap on U.S. government spending would likely mean that programs for the most vulnerable Americans will fall in inflation-adjusted terms. Limiting military spending would hurt active-duty personnel as well as veterans, while also crimping plans to replenish and modernize America’s heavily depleted arsenal after over a year of supplying Ukraine and Europe. It would curtail plans to expand the U.S. military presence in Asia to ring-fence China and limit programs to improve U.S. defenses against nuclear attack.

The government reached its debt ceiling of $31.4 billion in January. Since then, Treasury has since then been scrambling to shift its remaining cash around to keep repaying the government’s debts:

“Partisan standoffs over the debt ceiling have become an annual drama so regular that investors tend to shrug it off. One party, usually the fiscally conservative Republicans, threatens to bring the government to a halt until the fiscally liberal Democrats agree to some spending concessions, and catastrophe is averted at the eleventh hour. Ho-hum.

But sometimes the politicians miscalculate. In 2011, Congress raised the debt ceiling just two days before the government ran out of cash, but not before sparking major market turmoil that prompted one credit-rating agency to downgrade Washington’s AAA rating, declaring in effect that the emperor indeed has no clothes, and that the U.S. isn’t the safest borrower around after all.”

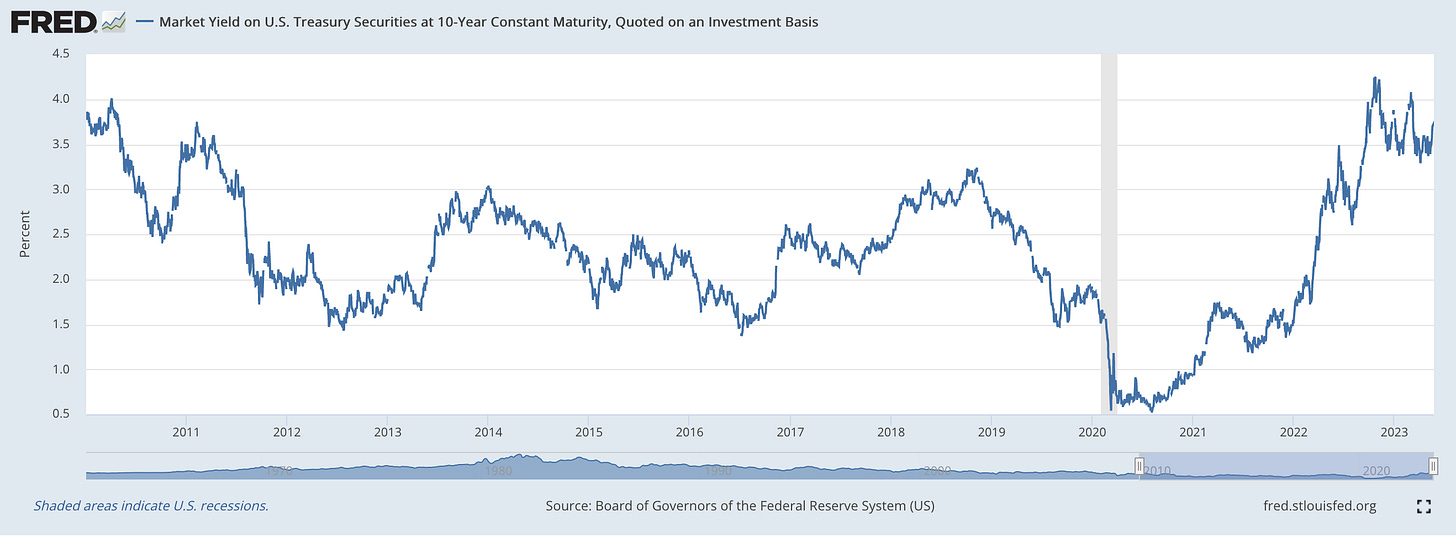

The big difference this time around is that Republicans pulled this stunt as the U.S. Federal Reserve was already in the process of raising interest rates, which has already made markets volatile as investors and companies adjust to rising borrowing costs.

As a result, the U.S. government—which is still selling bonds to replace those coming due—must pay at least 3.7% to borrow money for 10 years. A big test will come next Tuesday, when Treasury said it would sell $119 billion in 3-month and 6-month bills, largely to repay $117 billion in bills that come due on June 1. Yields on those maturing bills jumped as high as 7% this week before easing to roughly 5.8%.

The latest deal being discussed would raise the debt ceiling for two years, putting the next deadline in the lap of whoever wins the 2024 Presidential election. During that period, discretionary spending—the roughly 27% of the budget set annually by Congress—would be capped.

Military spending, which accounts for roughly half of discretionary spending, had become a sticking point in negotiations, as Republican hawks are eager to expand the military’s capabilities to confront China and Russia. Biden had reportedly demanded that any cuts to social programs be matched by cuts in defense spending.

But as he expands the U.S. commitment to Ukraine, Biden has unsurprisingly relented on military outlays, which would be allowed to rise. To keep discretionary spending capped, therefore, cuts would have to come in social services like transportation, education, and healthcare. To reduce the size of those cuts, $80 billion in funding to the Internal Revenue Service to ferret out tax-cheating among wealthy individuals and corporations will be cut by $10 billion. In 2025, the deal would allow for a 1% increase in discretionary spending, after which the deal’s limits would end.

The reported compromise is almost certain to face opposition by the Republican’s hardcore House Freedom Caucus. Democrats have also expressed resentment at having been left out of negotiations by the White House.