As Xi pulls China inward, its households batten down the hatches

(Originally published Aug. 25 in “What in the World“) China’s many economic problems are by now well-known. Solutions are difficult—and painful.

Beijing seems to have decided it can no longer resort to propping up the economy by further inflating the property bubble. Though it recently instructed banks to ease credit to the property sector, the central bank has held off cutting the benchmark rate for mortgages. Some analysts say that was to avoid squeezing banks’ lending margins further as they face the prospect of massive write-offs on loans to developers.

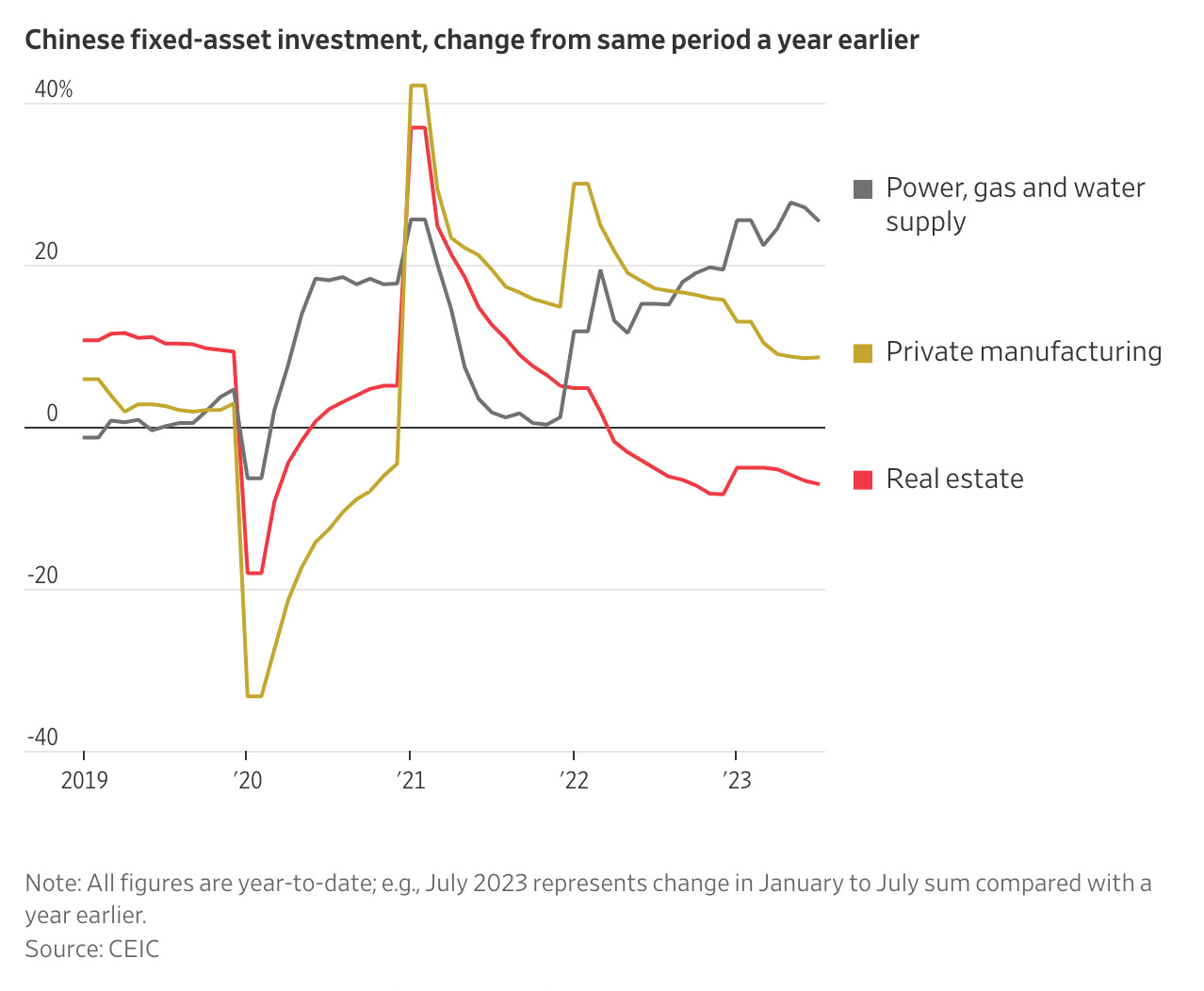

China’s President Xi Jinping apparently refuses to unleash the kind of fiscal stimulus economists and investors say is necessary to revive growth. Infrastructure investment, another tried-and-tested wheeze, has already left China with famously empty airports and unused railways. The government appears to now be pouring increasing funds into power, gas, and water supplies.

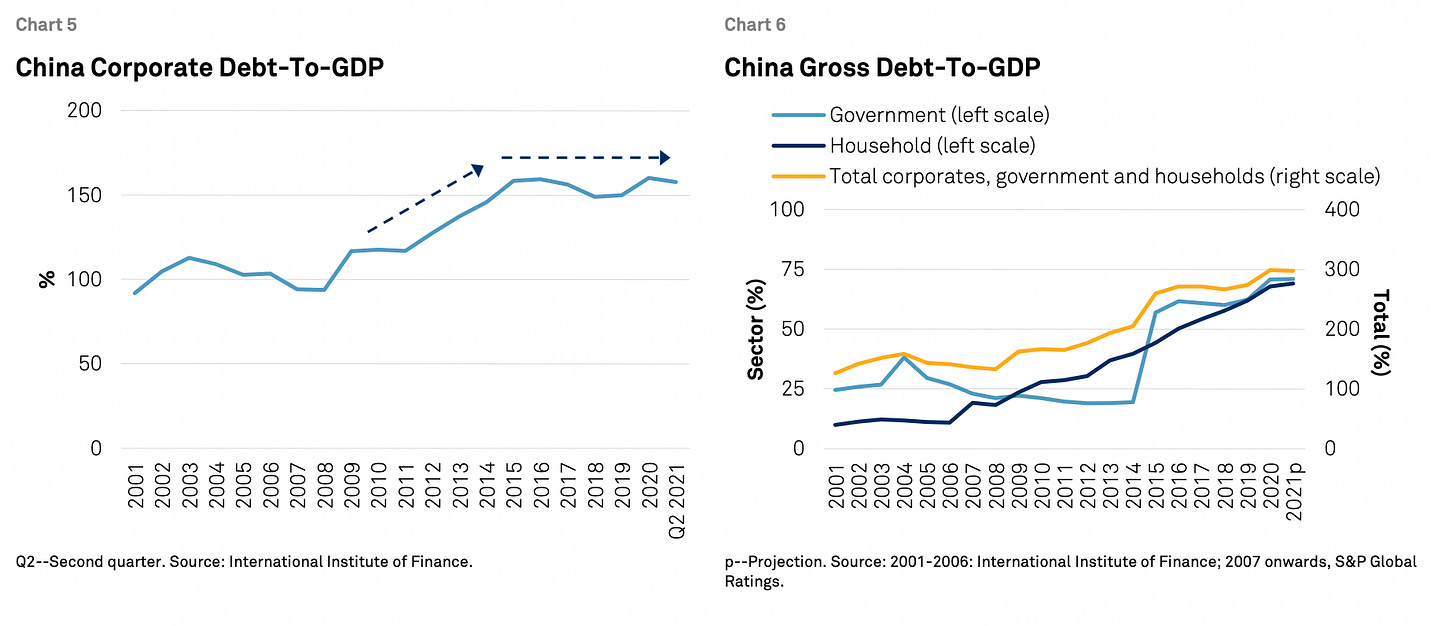

Xi is also reportedly loath to boost Beijing’s own borrowing and use taxpayer cash to bail out profligate citizens who made their wealth with debt. Markets fear he’d prefer instead to let the economy to suffer, even if it means the destruction of savers’ fortunes and putting more young graduates out of work, if it helps shed flabby sectors reliant on debt and create a leaner economy better suited to China’s long-term contest with the West.

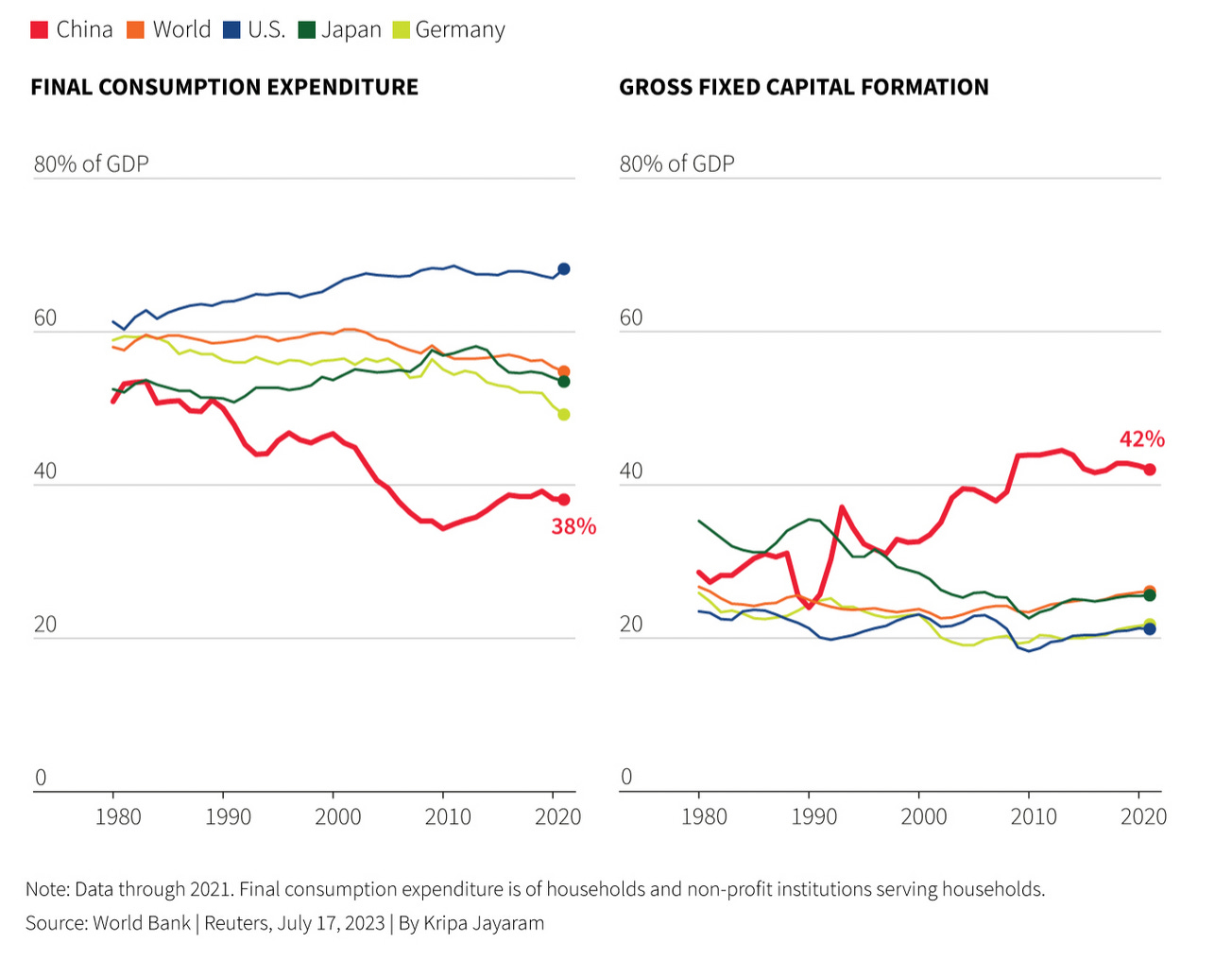

What Beijing seems short of are solutions. And for this Westerners blame Xi and his autocracy. Adam Posen at the Peterson Institute for International Economics recently blamed Xi’s autocracy for shattering consumer confidence and with it spending, which still only represents less than 40% of GDP.

Now The Economist blames Xi’s autocracy for crippling the bureaucracy with yes-men who put loyalty to him above finding bold solutions. Journalist-turned-academic Ian Johnson argues in Foreign Affairs that Xi is steadily pulling China back behind the iron curtain from which it emerged in 1978—an “involution.”

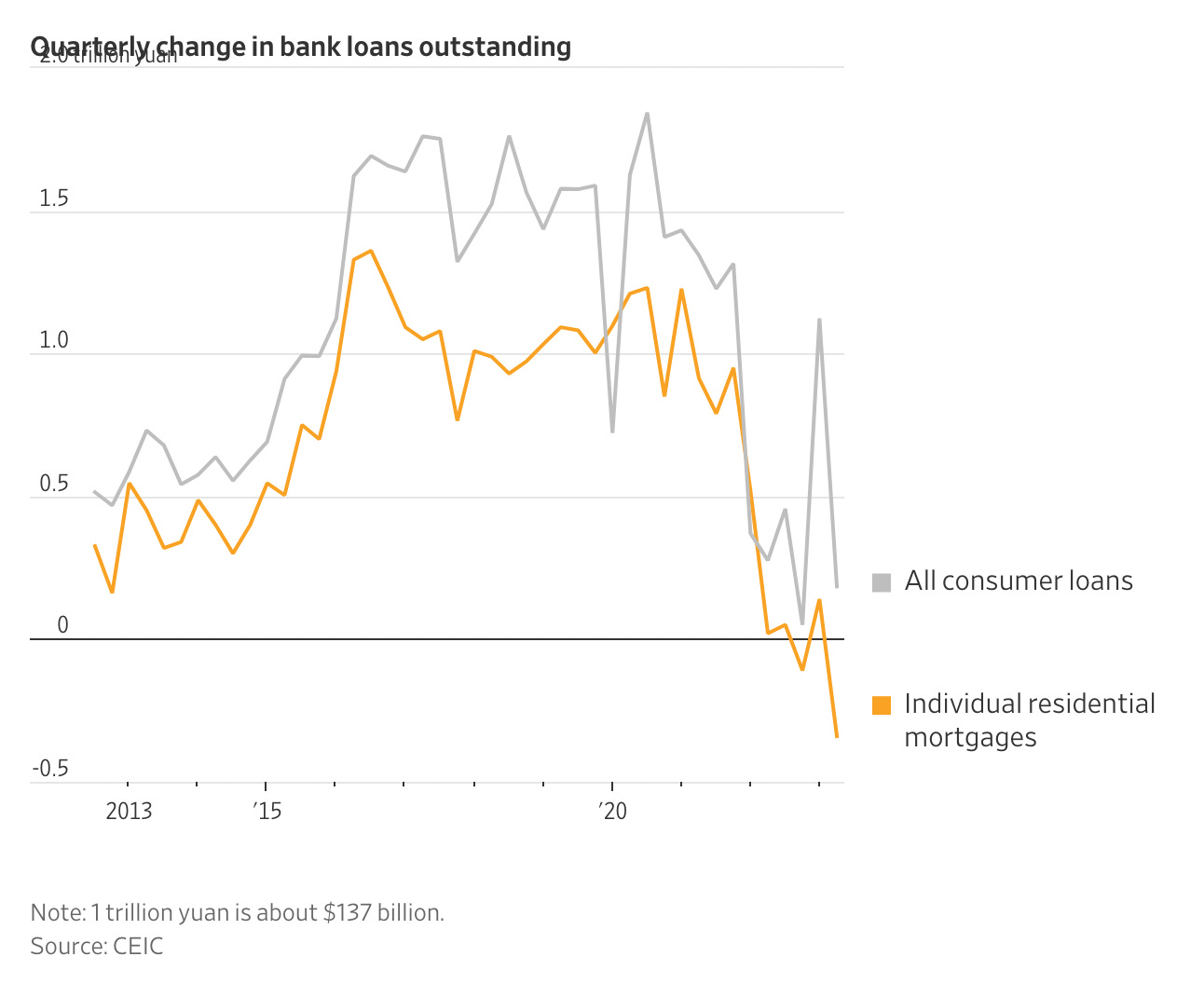

Either way, China’s households are on the brink. In the past several years, Beijing has tried to shift some of the debt in China’s corporate sector to households, resulting in a dramatic increase in household debt.

But the job market is weak, property prices are falling, and developers aren’t completing new buildings China’s savers bought “off-plan” using mortgage money. And despite being a communist country, China’s social safety net is in tatters. So, households are battening down, using their incomes to pay off those mortgages and consumer loans. That means they aren’t spending or taking out new loans, bad news for banks and for China’s domestic service sector.