Cheaper Chinese tech not welcome as Biden fends off vote-killing price increases

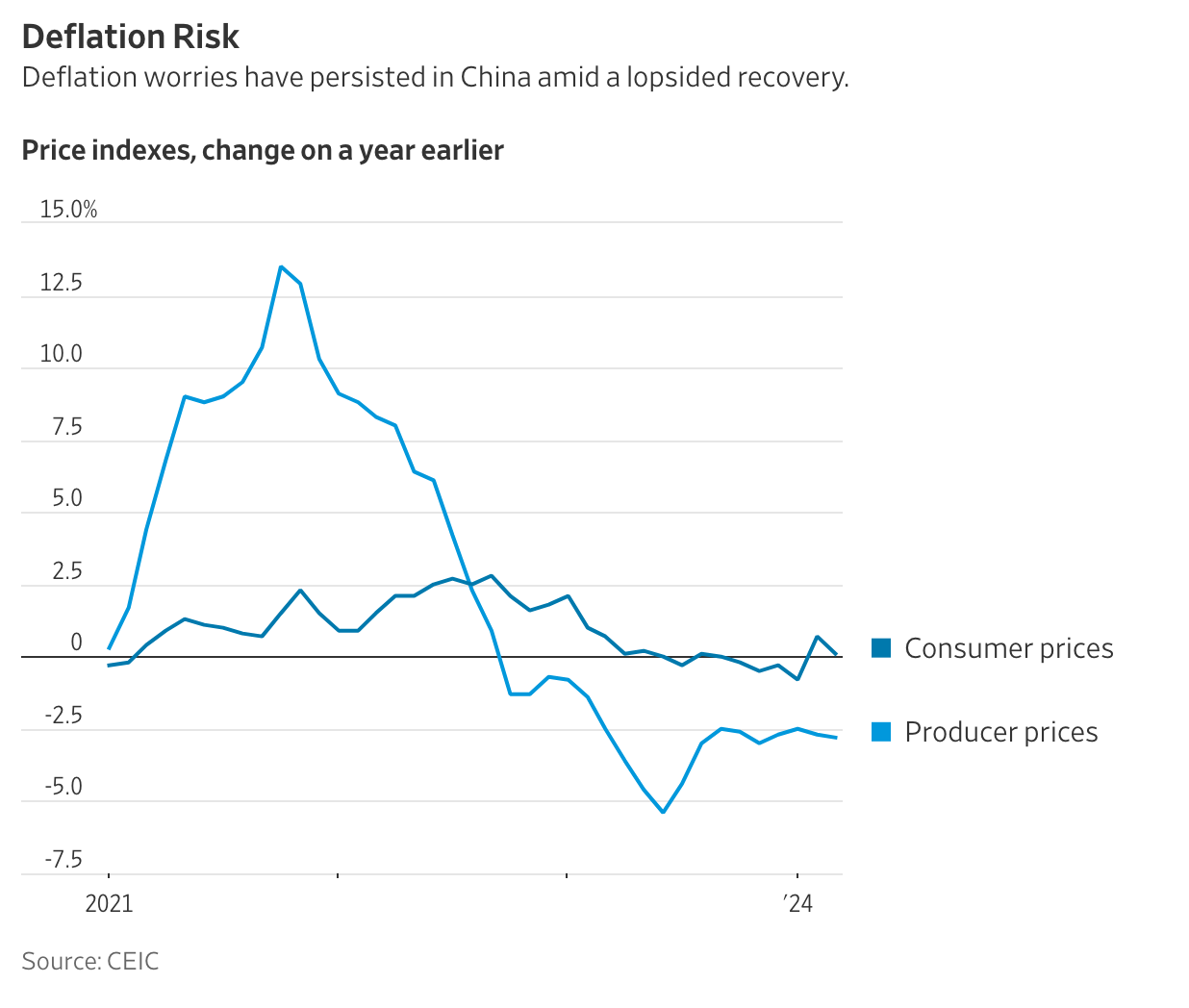

(Originally published April 12 in “What in the World“) China’s deflationary pressures continue to mount, causing ructions with trading partners like the U.S. eager to reduce their economic reliance on China, especially in advanced technologies.

Producer prices in China dropped 2.8% in March from a year ago, extending a slide that began in September 2022. Consumer prices, meanwhile, eked out a lower-than-expected 0.1% year-on-year increase in March.

Those lower prices for factory goods are in part a reflection of weak domestic demand, but also of accelerating investment in manufacturing. That increase in supply is in part what lies behind accusations by Washington and other trading partners that China is barraging the world with cheap exports.

During her visit to China last week, U.S. Treasury Secretary Janet Yellen accused China of dumping subsidized “green-tech” products—like electric vehicles, batteries, and solar panels—on global markets. The White House is unhappy about the wave of cheaper Chinese products because, though they help blunt the kind of inflationary pressures that are hurting U.S. President Joe Biden in the polls, they also blunt the benefit of Washington’s own subsidies for domestic green-tech manufacturing. And that hurts the White House’s efforts to “decouple” from China and reduce America’s reliance on its products, particularly high value-added ones.

While it’s true that Beijing has been encouraging investment into green-tech to revive growth and, well, alleviate climate change, green-tech products still represent just a sliver—less than 6%—of China’s overall exports. The deflationary pressures Chinese exports are exerting globally are across the board, not in green-tech. And if U.S. inflation numbers are any indication, they aren’t succeeding in exporting China’s economic weakness much at all.

Washington’s opposition to China’s green exports seems more to do with protecting a strategically important, domestic industry at the world’s expense. As Bloomberg columnist David Fickling noted recently, China and the rest of the world have promised to ramp up production of green-tech products because they still don’t produce enough to meet globally agreed goals of reducing greenhouse gas emissions and keeping global warming within 1.5°C.

Fitch Ratings joined rival Moody’s this week by lowering its outlook for China’s creditworthiness to “negative” from “stable” as the government borrows more to prop up the slowing economy.

Moody’s lowered its outlook to negative last December. Fitch forecasts that official central and local government debt will climb to 61.3% of GDP this year, from 56.1% last year, while the government’s budget deficit will rise to 7.1% of GDP from 5.8%, the highest level since Beijing’s battle with Covid in 2020 forced it to raise the deficit to almost 9% of GDP.

Like Moody’s, Fitch’s rating of China’s creditworthiness remains unchanged, at A+. Lowering its outlook suggests it may be considering a downgrade, however.

The Asian Development Bank, meanwhile, warned that China’s slowing economy was slowing growth around Asia. The ADB forecasts developing Asia’s combined GDP will grow 4.9% this year, down from 5% for 2023. Slowing Chinese demand it said, would likely pull growth in China down to 4.8% this year, from 5.2% in 2023. “A protracted and severe downturn would negatively affect the growth outlook, with potential spillovers to trading partners.”