China’s consumers cut back as salaries fall; local governments trim services to pay rising debt

(Originally published July 31 in “What in the World“) White-collar workers in China are suffering pay cuts as the nation’s economy slows.

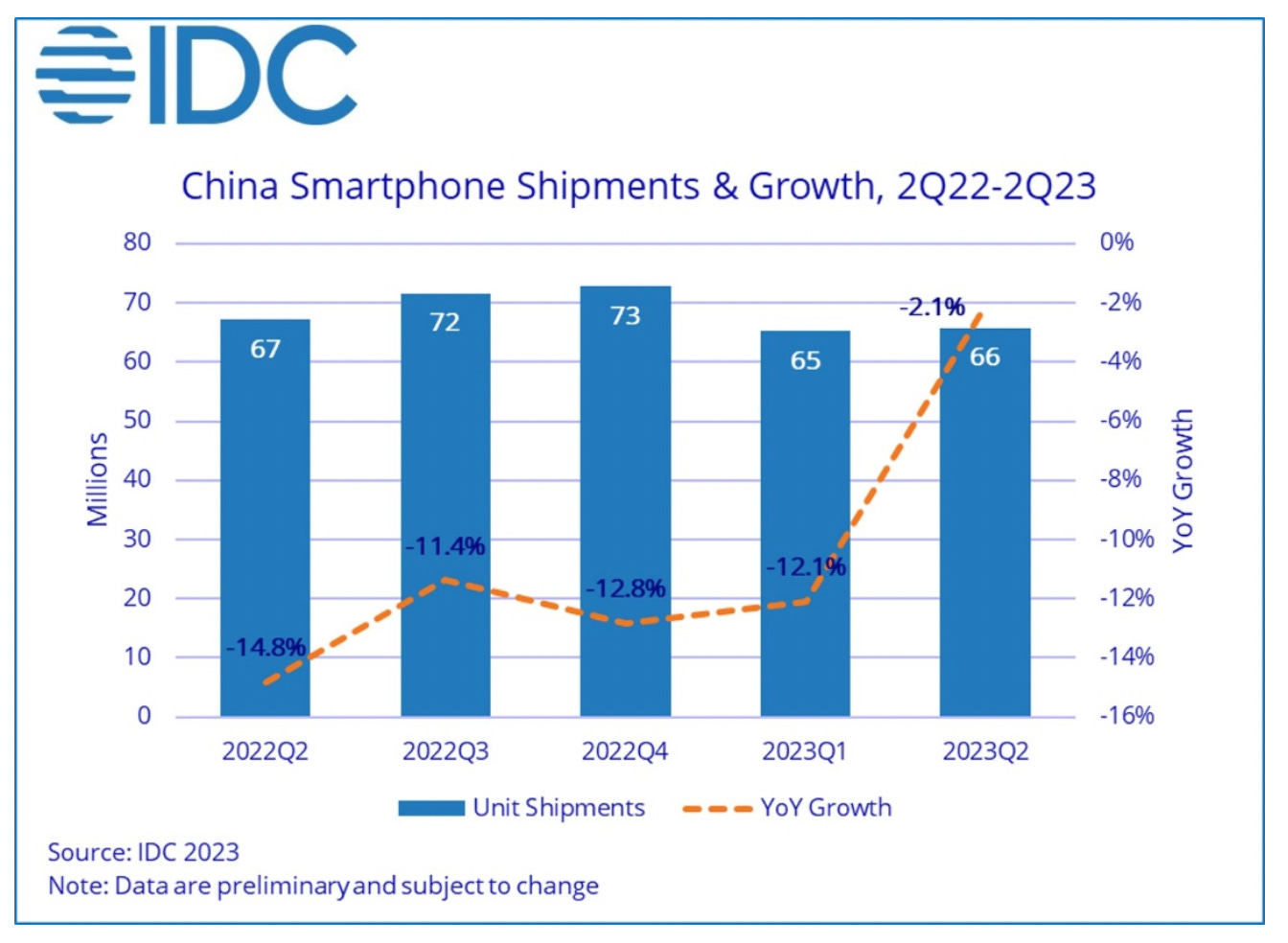

The lower salaries, which have affected workers in finance, local governments, schools, and hospitals, are contributing to weaker consumer sentiment. That, in turn, is affecting sales of consumer gizmos like smartphones. Smartphone sales fell 7.3% year-on-year in the first six months of 2023, according to IDC. Sales in the second quarter fell 2.1% year-on-year after having dropped by double digits for the previous four quarters.

Concerns that provincial and municipal governments may go bust under the load of massive debts continue to grow, meanwhile. Some governments have already begun trimming public services like bus routes so they can keep making debt repayments.

Much of their debt is owed through local government financing vehicles (LGFVs). Despite efforts in 2015 by Beijing to get provincial governments to roll LGFV bonds over into provincial government bonds, the International Monetary Fund estimates LGFVs may have now racked up as much as 66 trillion yuan ($9.28 trillion), more than double what they had in 2017. That’s higher than the 50 trillion yuan estimate recently cited in this space, and amounts to almost three-quarters of the 90 trillion yuan in total estimated local-government debt.

So far, no LGFV has defaulted on its bonds, but default among LGFVs traded in the exchanges, but there have reportedly been dozens of LGFV defaults on private loans this year, most in the cash-strapped provinces of Guizhou and Shandong. If they do start defaulting, it could quickly ripple through China’s banking system: by at least one estimate, LGFVs’ bonds may now account for up to 40% of assets at China’s banks.

Even as Beijing urges local governments to refinance those debts by selling new bonds, China’s banks appear to be taking preemptive measures. In Shandong province, where LGFV’s owe an estimated 4.3 trillion yuan in debt, state-owned China Development Bank, Agricultural Bank of China, and China Construction Bank have reportedly helped fund new companies to bail out several city governments’ LGFVs, including the coastal city of Qingdao.