More property tremors rock China’s economy as foreign investors flee

(Originally published Dec. 29 in “What in the World“) Evidence continues to mount that China is on the verge of property-led credit crisis.

Now even state-owned developers are withholding payment to contractors, according to the South China Morning Post, defying orders from on high to pay bills promptly. As described in this space back in August, denying payment to the small companies that provide equipment and services to bigger ones makes it harder for them to pay their own bills, and wages, and can eventually force them out of business.

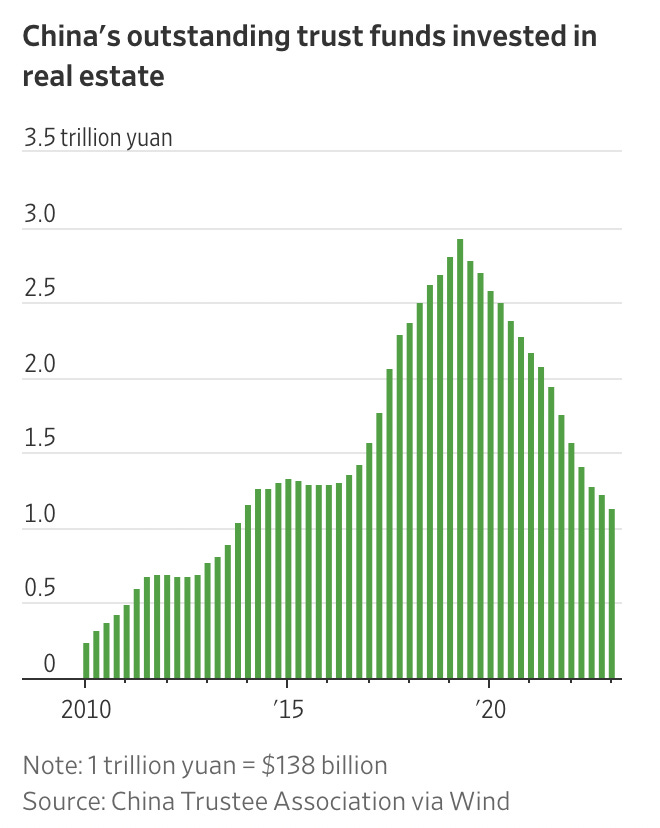

Trouble continues to ripple outward from the earthquake in property prices. Earlier this month, state-backed developer China South City Holdings sought a debt restructuring from creditors to avoid defaulting on its offshore debt. And Zhongrong, one of the trust companies covered in this space back in August, has warned its customers it won’t be able to make payments on their products according to schedule. The massive investment company that manages it and co-owns it, Zhongzhi Enterprise Group, is now at the center of a police investigation.

As explained here at the time, trust companies grew by stepping into the void created when authorities like the People’s Bank of China tried to restrict the property bubble by limiting bank lending to new projects:

Trust companies were the loophole around those bank restrictions. They operate something like banks, but instead of taking deposits, they sell investment products, then either lend that money to property developers, buy property-linked bonds, or take stakes in property projects. Only because anyone with a sound property project could still get funding from banks, trust companies are largely left investing in the riskiest projects that are most exposed to the property downturn and most likely to go belly-up.

Now Beijing has decided to de-fang its central bank and put financial and economic policymaking more firmly in the hands of the Communist Party as President Xi Jinping reverses years of pro-market reforms to centralize policymaking.

Foreign investors are storming the exits. They poured roughly 235 billion renminbi into Chinese stocks as of August on a bet that Beijing would be forced to step in, bail out deeply indebted developers and local governments, and spend big to revive growth and public confidence. It didn’t. So, since August, investors have pulled almost 90% of those investment back out, according to the Financial Times.

As described in this space in mid-August:

Investors are betting Beijing won’t come to the rescue and are selling stocks. Beijing has resisted because doing so would mean borrowing more money and effectively socializing the debt bubble that was created building the very un-Communist mess China’s economy is in. It would be a massive bailout of the citizens who used debt to build massive fortunes in property and tech at the expense of the poor. In short, it would be a lot like the U.S. response to the global financial crisis—a bailout of the rich to save the entire economy from ruin.