China’s ossifying economy creaks as Yellen arrives to turn back tide of exports

(Originally published April 5 in “What in the World“) U.S. Treasury Secretary Janet Yellen is kicking off four days of meetings in China with a warning to Beijing against exporting cheap green technology to the United States.

Yellen, meeting American executives in Guangzhou, dressed Washington’s latest protectionist policy as helpful economic advice, saying China can’t hope to use exports to revive economic growth. On the contrary, its industrial overcapacity for solar panels, semiconductors, and electric vehicles, she said, is hurting both its competitors abroad and itself.

Yellen isn’t the only one conveying the White House’s warning to Beijing. U.S. Commerce Dept. officials met with their Chinese counterparts in Washington Thursday to discuss U.S. concerns that cheap Chinese exports are blunting U.S. subsidies to American green-tech companies.

And while the White House is trying to quell Chinese high-tech imports, it’s simultaneously restricting U.S. high-tech exports to China. U.S. President Joe Biden warned China’s President Xi Jinping in a phone call Tuesday before Yellen’s trip that the restrictions were necessary “to prevent advanced U.S. technologies from being used to undermine our national security.” Xi countered that the export restrictions “suppress China’s trade and technology development” and are “creating risks” for bilateral ties.

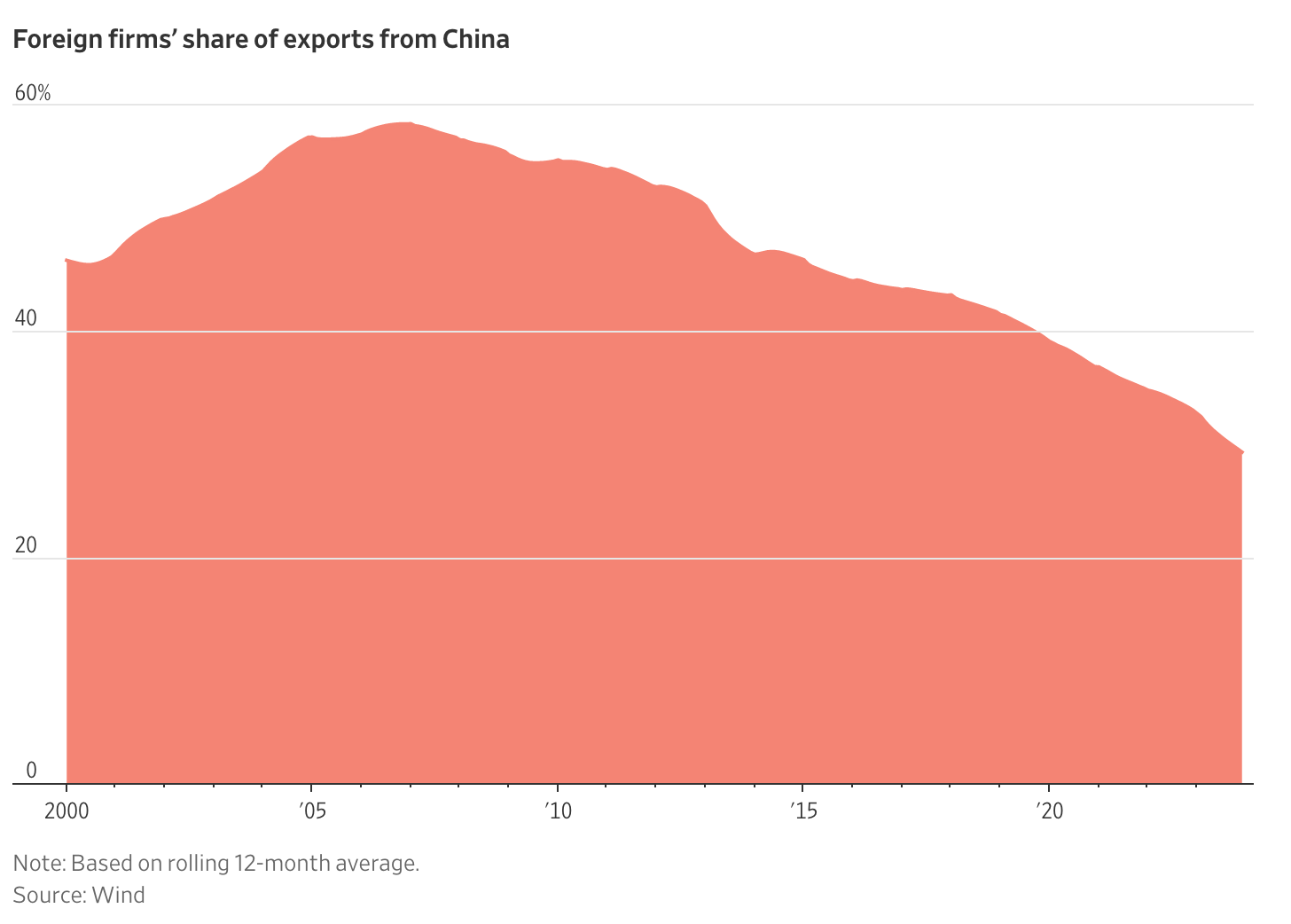

Washington’s efforts to reduce U.S. high-tech trade with China seem to be working. Combined with slowing growth and rising legal uncertainty, some foreign multinationals are reducing their overall exposure to China by channeling new investment into other countries. Others are even reducing their overall investment in China. This is especially true for American companies, and even more acute among those in high-tech, where political sparks are hottest.

Combined with the growth of domestic China brands and Beijing’s own efforts to promote them, foreign companies now represent a lower share of China’s overall exports.

Many companies are shifting their investments into America’s cheaper southern neighbor, Mexico. One lure, according to The Wall Street Journal, is the U.S.-Mexico-Canada free-trade agreement that went into force in 2020 and has attracted billions of dollars in new investment from companies moving manufacturing to Mexico from China.

Alas for the Journal, this trend isn’t new. Mexico toppled China as the top U.S. trading partner a year ago, as was highlighted in this space last July:

China has been toppled by Mexico as America’s largest trading partner, as Washington looks to punish China economically and shelter U.S. supply chains from the fallout of its escalating feud with Beijing.

According to data from the U.S. Census Bureau compiled by Luis Torres, an economist at the Federal Reserve Bank of Dallas, bilateral trade between the U.S. and Mexico in the first four months of this year represented more than 15% of all U.S. foreign trade, compared with 12% for U.S.-China trade.

The downturn is largely thanks to an economic war against China by the U.S., directed by the White House and executed in large part by the tiny Bureau of Industry and Security. Amid deteriorating relations between Beijing and Washington, in 2018 former President Donald J. Trump imposed tariffs on roughly two-thirds of Chinese imports. China retaliated with its own tariffs on U.S. imports.

Supply-chain disruptions during the pandemic also prompted many U.S. companies to start diversifying their supply chains. But Washington is now actively encouraging importers to “re-shore” supplies away from China and strangle China’s access to top U.S. technology.

The shift is part of an effort to contain China’s growth, de-couple the world’s two largest economies and punish Beijing for a range of perceived sins, from unfair trade practices and allegations of human rights abuses to aggressive military moves against Asian neighbors and espionage against the U.S. government and companies.

The latest evidence of the trend is February’s announcement that Apple supplier Foxconn had bought $27 million of land in Mexico, part of $690 million it has invested in the country over the past four years. Foxconn reportedly makes servers in Mexico for Amazon, Microsoft, and “AI” chipmaker Nvidia.

China has bigger problems at home. China’s working-age population is saving less for retirement. Given weakening economic growth and record youth unemployment, that’s little surprise. But falling pension contributions—both to company pension plans and personal ones—are adding to concerns that China’s public pension system can’t support the rapidly growing number of pensioners in an aging nation with an average retirement age of just 54.

China’s population is already shrinking, with a birthrate so low that by 2050, 40% of the country will be over 60. Analysts warn that Beijing either needs to raise the retirement age or start cutting benefits. At the current rate, the Chinese Academy of Social Sciences says, the public pension will run out of money in the next decade.